How much research participants want to be paid

Good research is almost always incentivized. And people want money for taking part in research. But how much should you offer?

Deciding on the right incentive amount is a delicate problem: pay too little, and you won't get enough participants. Pay too much, and you blow up your budget. We did some research to find out the right amount to offer to keep both your participants and your budget happy.

We’re not the first to try to figure this out. Other companies have created incentive calculators based on historical data. They’re valuable and insightful. But their work is retrospective in nature. It’s an analysis of the status quo — how thousands of researchers have paid participants for various types of research in the past.

We took a different approach. In partnership with The Decision Lab, we used conjoint analyses on over 3,000 data points to measure what participants actually want. You can read the full methodology at the end.

To arrive at a more nuanced answer, we also approached a number of sub-questions, such as:

How much should you pay for a survey versus an interview?

By how much should you increase the incentive if it’s a 5-minute commitment, a 15-minute one, or something much longer?

Does it matter if the research is about a sensitive topic compared to something surface-level?

To what degree does the preferences of your target population matter?

And how do participants value (or devalue) different incentive types, like cash, Amazon.com Gift Cards, Visa prepaid cards, and charitable donations?

By taking this approach, we’ve been able to measure how the individual variables interact and impact how much you should offer.

With this guide and our research incentive calculator, we’ll help you get the most bang for your buck — while still doing right by the people at the heart of your study.

Calculate an incentive in seconds

Just looking for an answer and not an explanation? Test out our research incentive calculator.

Watch the webinar

Jump to the section you care about

Step 2: Choose between quantitative versus qualitative research

Step 5: Pick an incentive that appeals to research participants

Step 7: Piece together research incentives your participants will love

How to approach research incentives, at a glance

We’ve got a super-short answer, a shorter answer, and the long answer.

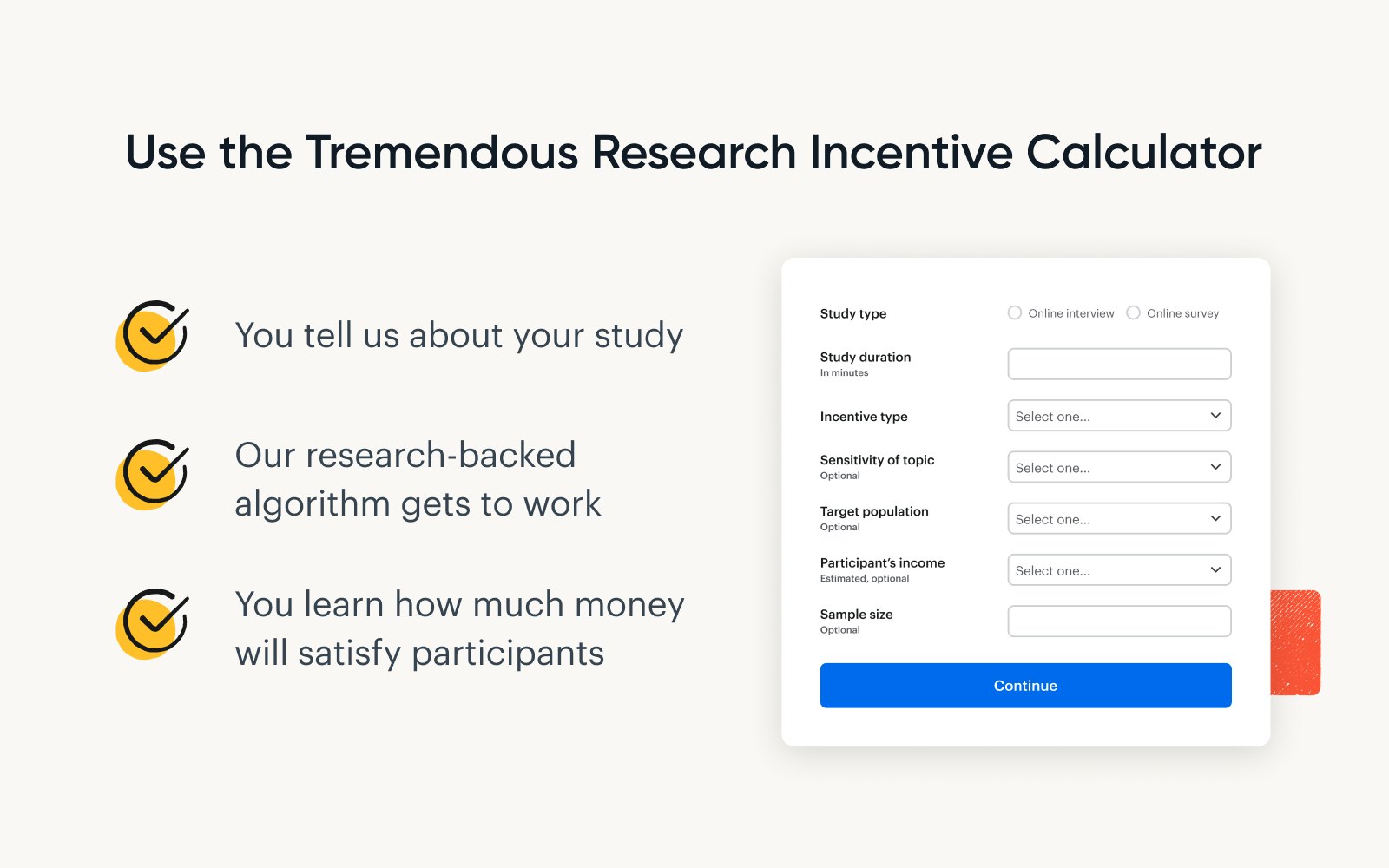

Super-short answer: Answer a few questions about your study and the Tremendous Research Incentive Calculator will suggest how much to offer.

Short answer:

As a base, you should pay participants $1.76 per minute. As duration increases, the cost-per-minute gets cheaper. (We explain why below.)

Interviews cost more than surveys. For a 30-minute interview you should pay about $57, compared to $48 for a survey.

Students are comfortable with a lower rate than those in the workforce. And, people earning $200,000 or more expect much higher compensation for their time.

And it also matters how you send the incentive.

In a separate survey of Tremendous clients, we found that 49% incentivized research using Amazon.com gift cards prior to switching to Tremendous. Yet, in our research with The Decision Lab, we discovered that most participants don’t want to be boxed into a single retailer … even if that retailer is Amazon.

Here are some highlights from our research:

Research participants primarily want to be paid in cash transfers. You have to offer more to achieve the same perceived value when using other payout options, such as Visa or Amazon.com gift cards.

However you need to balance optimizing for what recipients most want against your own operational needs

People who earn more than $50,000 a year always welcome a gift card when they’re given the ability to select one from a list of retailers.

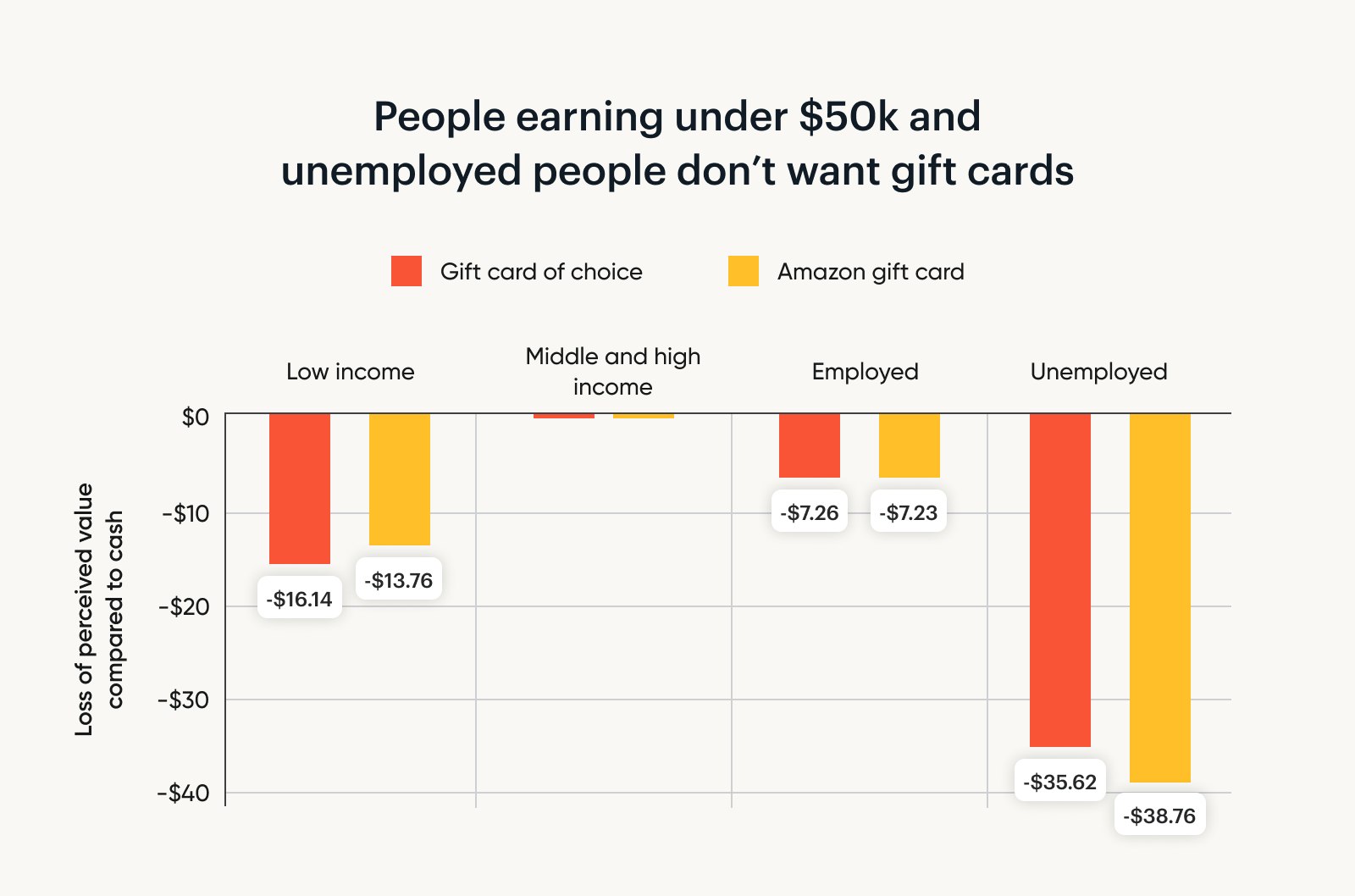

Unemployed people want to be paid over $35 more if they’re paid with a gift card.

If you are an occasional researcher, this might be enough for you to go on. If figuring out how and how much to pay subjects is a meaningful part of your work, you might want to keep reading.

Step 1: Figure out how long your study takes

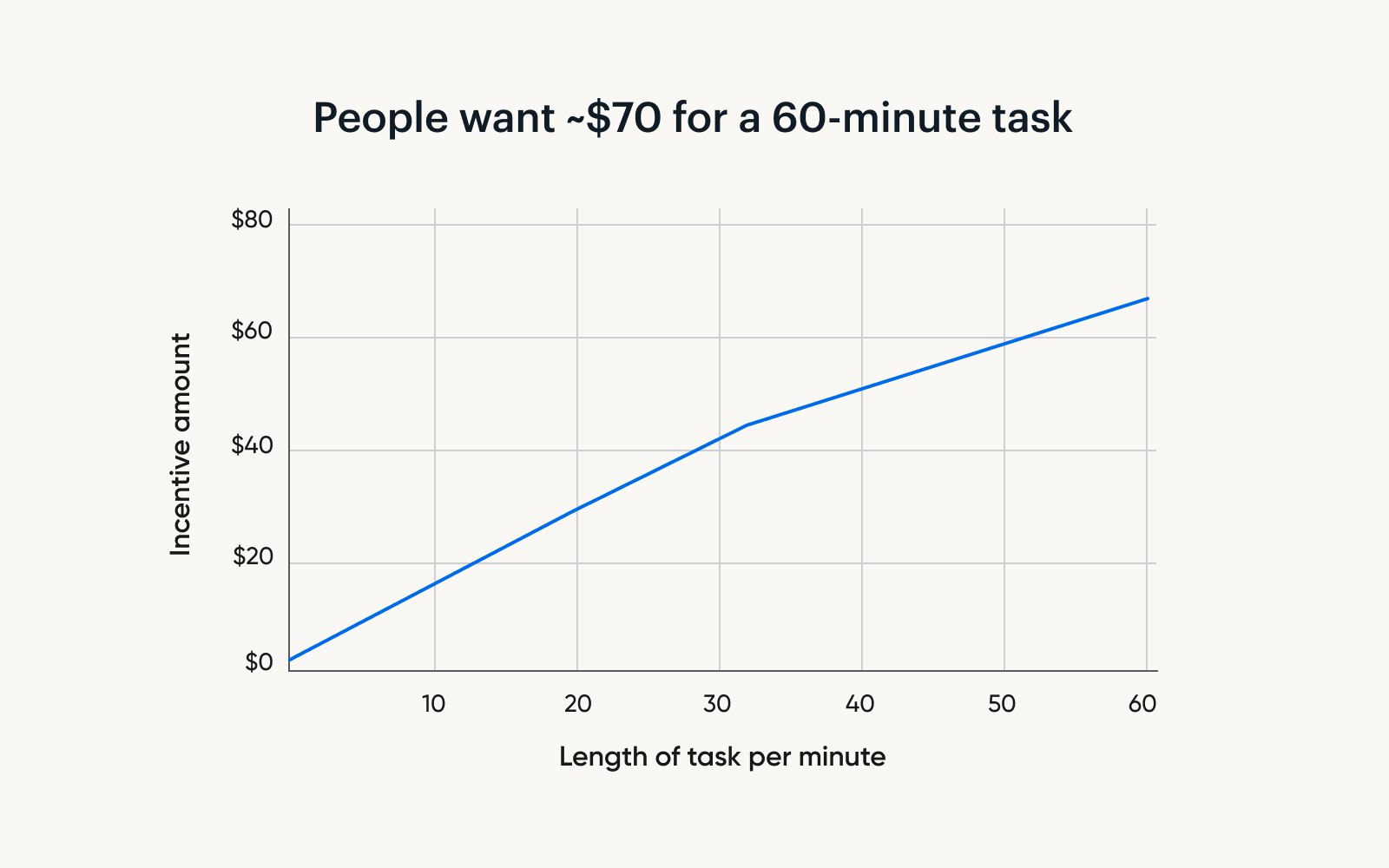

Time is the most important variable to prospective participants. So the first step to finding the optimal incentive is to figure out how much time you’re asking of participants.

For the sake of simplicity, we’ll share some heuristics. On the whole:

For a 15-minute task, people want $26.40.

That jumps to $48.00 for a 30-minute task.

And to a little more than $69 for 60-minutes.

Keep in mind, though, that these numbers are viewed in isolation. Once you start factoring in the study type, participant demographics, and other variables, these amounts change.

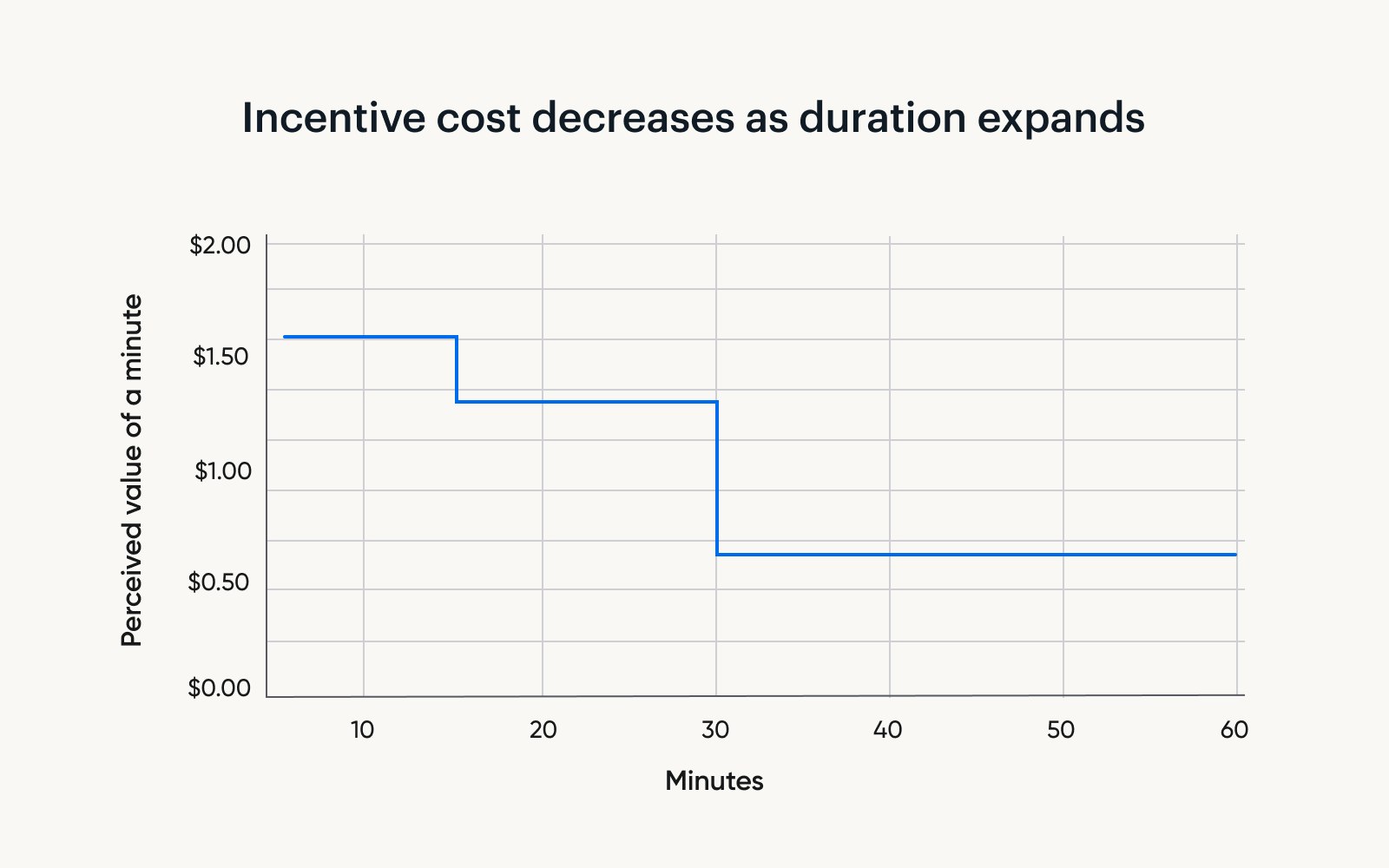

One thing that may surprise you is that the longer your experiment runs, the cheaper each additional minute becomes. For example:

Say you are increasing the length of your study to 15 minutes from five. For these ten additional minutes, each minute will cost you $1.76.

Now, say you increase the length of your study from 15 to 30 minutes. The price of each additional minute is now $1.44.

Finally, say that instead of 30 minutes, you decide to stretch your interview into a full hour. Now, each additional minute will cost only $0.71.

These findings have important implications for how researchers should approach their experimental designs.

While some researchers may worry about how increasing study length will impact participant motivation, it may in fact be relatively inexpensive to include additional questions while still adequately compensating respondents.

Step 2: Choose between quantitative versus qualitative research

By using the discrete choice methodology, we present participants with two options and ask them to choose which is better. This allows us to analyze their preference of different variables, and assign a dollar value to their preference.

Sample discrete choice set

| Research project A | Research project B |

|---|---|

| Understanding consumer breakfast cereal preferences | Investigating household budgeting and debt management behaviors |

| 30 minute online interview | 60 minute online interview |

| Receive a $46 cash transfer (via Paypal, Venmo, or bank transfers) as compensation | Receive a $96 mailed check as compensation |

| Receive half of your compensation upon signing up, and half after completing the task. | Receive your full compensation after completing the task. |

With this information, we know whether people prefer taking a survey vs. participating in an interview.

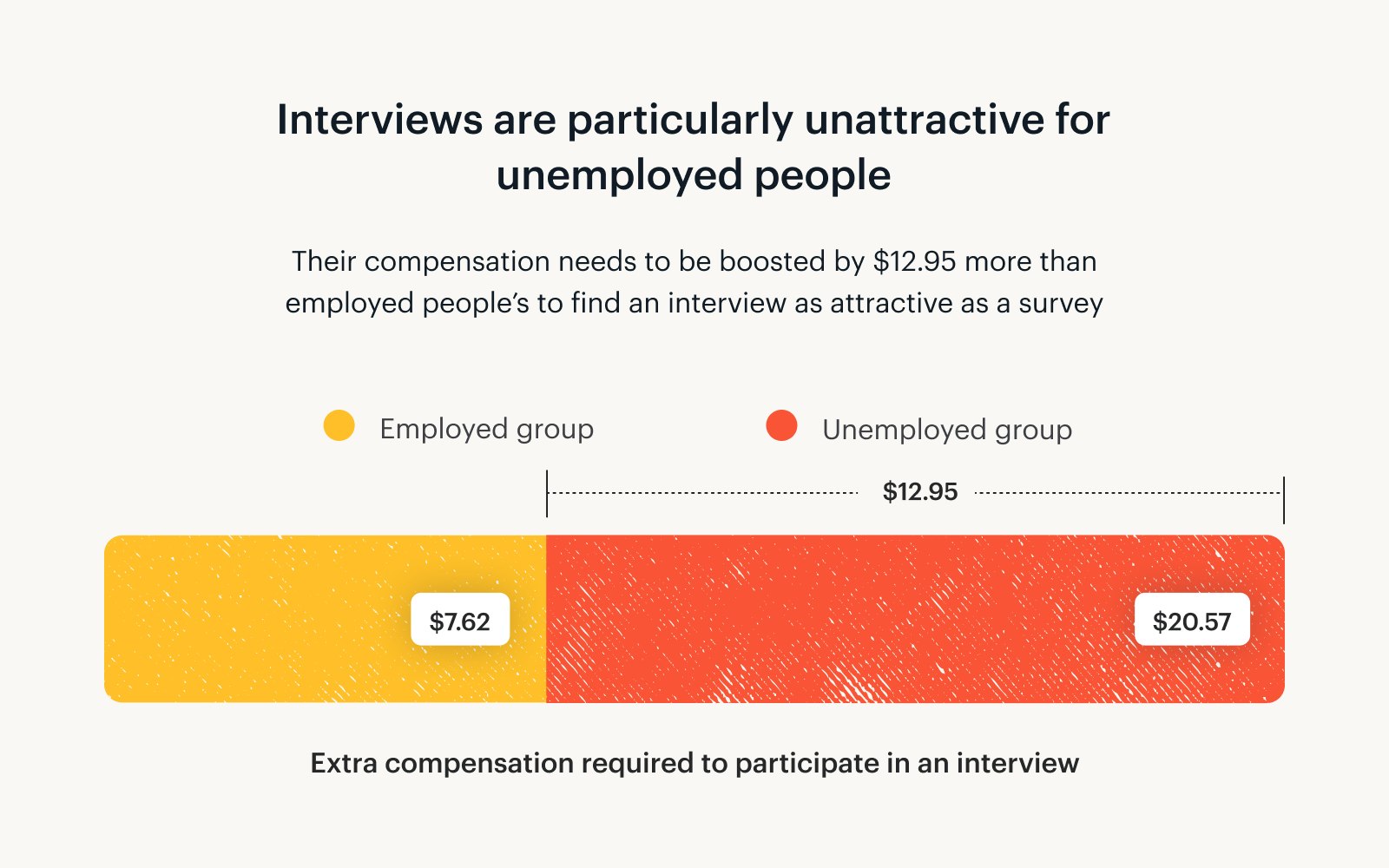

Turns out, people prefer studies that do not require talking to an actual person — namely, our participants showed a preference for online surveys over online interviews.

On average, online interviews need to be compensated at a flat rate of $8.66 more than surveys to be an equally attractive option.

One quirk we found: Unemployed people need to be compensated $20.57 more to do an interview compared to a survey, while for employed people the difference is only $7.62.

Step 3: Does your study get personal?

Researchers also need to think about the sensitivity of the subject matter at hand.

In our study, we probed how different topics affected participant motivation levels. We asked our participants to choose between two research projects: one about their breakfast cereal preferences, and one about household budgeting and debt management.

For interviews and surveys that take longer than 30 minutes, we found that participants would need to be compensated $3.40 more if the experiment deals in sensitive or personal subject matter (e.g., household debt) as opposed to surface-level content (e.g., cereal preferences).

Asking someone to talk about a topic like household debt for an hour will require about $9 extra in compensation compared to asking someone about a more casual subject for the same period.

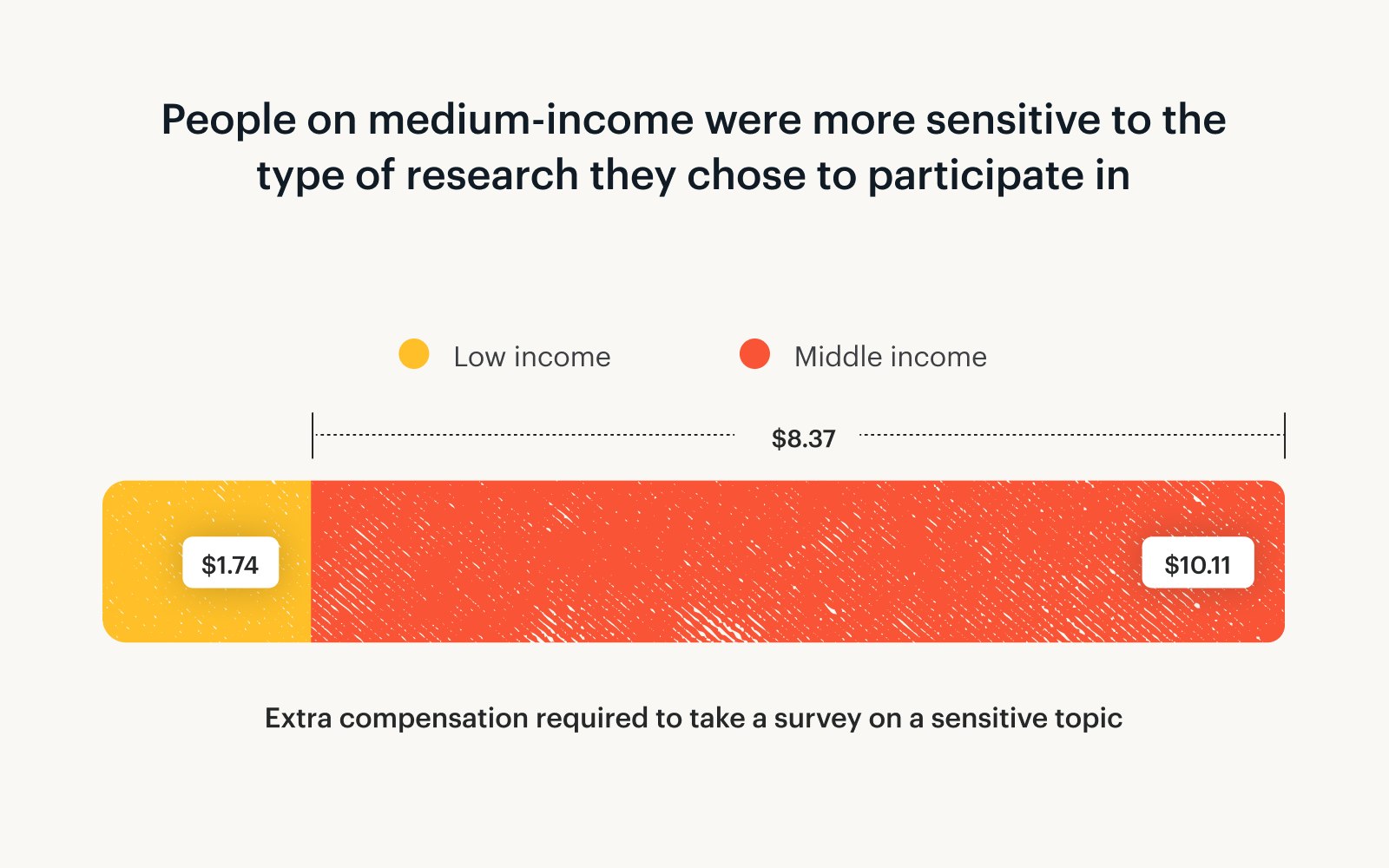

Middle-income earners (people earning between $50k and $100k) showed the strongest sensitivity to research topic: they would need to be compensated on average $8.37 more than someone with a <$50k income to take a long survey about a sensitive subject.

The causality of this finding is unclear — is debt a particularly touchy subject for middle-income earners? Or is cereal a particularly exciting one?

Step 4: Determine your target population

Who you target for your research matters, but some characteristics matter more than others.

Income mostly don’t matter

Intuitively, we might expect participants’ income to affect their perception of research incentives. You might think that high earners would assign greater value to their own time, and you’d be right.

In our sample, respondents at the highest end of the wealth spectrum did have noticeably higher expectations for research compensation. Specifically, those earning $200,000 or more needed to be paid 46% more than low-income earners (under $50,000) for the incentive to have the same appeal.

However, for the most part, all the people we surveyed valued their time equally, regardless of whether they were working or how much they were earning.

On the other hand, there's one group willing to be paid less: students. A lot of university research relies on students for their studies. And, indeed they are the most cost-effective group.

Addressing B2b versus B2C

We anticipate you’ll ask: how should I toggle incentives up or down if I’m targeting a B2B versus a B2C population?

Whether someone is a consumer or business person is contextual. The same person could be one or both depending on the setting. And with our methodology, we weren’t able to test that.

We understand that this isn’t the most satisfying answer. If you want to provide feedback on how we should improve our research, email us at research@tremendous.com

Step 5: Pick an incentive that appeals to research participants

We tested a variety of different incentive types to see which are the most appealing to research participants.

The table below explains what each incentive type is. It also shows the short-hand we’ll use for the remainder of this guide.

Incentive types & shorthand

| The incentives we tested | Short-hand |

|---|---|

| Cash transfer (via Paypal, Venmo, or bank transfer) | Cash transfer |

| Digital Visa prepaid card | Visa prepaid card |

| Digital gift card of your choice (choose from 1,000+ options) | Gift card or choice of gift card (This is a gift card to a single retailer that the recipient chooses from Tremendous' options.) |

| Digital Amazon gift card | Amazon.com Gift Card (These are the most commonly selected gift cards from the Tremendous catalog of options. This is considered a proxy for gift cards to any single retailer.) |

How incentives are delivered to participants can impact motivation levels. Overall, cash transfers are always preferred, especially if you’re hoping to engage a lower-income audience.

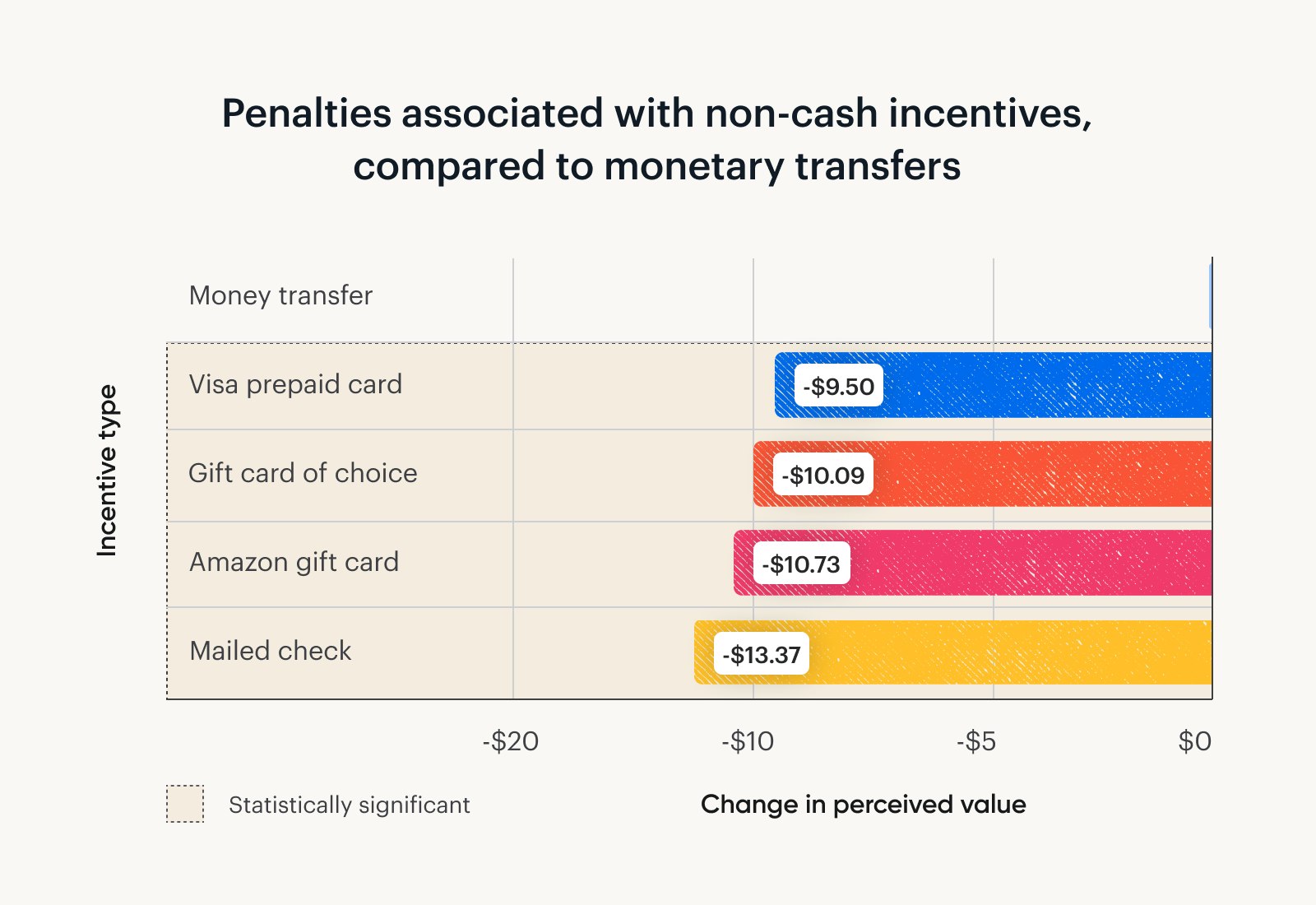

Specifically, cash offers at least $9.50 of additional value over any other incentive type we studied. This holds true for all study lengths.

On the flip side, mailed checks need to be $13.37 larger to be perceived as equal in value to a cash transfer.

After cash, Visa prepaid cards are the next best option, presumably due to their flexibility.

Gift cards of the participant’s choice were valued slightly more than gift cards specifically for Amazon.

☝️ So why not just offer cash transfers?

While participants prefer options like bank transfers, PayPal and Venmo, they’re either a pain or expensive to offer.

Sending money to many people directly from a bank or PayPal account is tedious, fraught with errors, and risks tripping fraud alerts.

Doing it through a platform like Tremendous is smoother, but typically comes with a fee. And in both cases, international transfer options are limited.

Many researchers find that the happy medium is to offer a payout redeemable for a wide assortment of prepaid and gift cards — which, if you use Tremendous, is simple, free, and covers over 200 countries.

We also found some interactions between participant characteristics and the incentives they preferred. Namely:

If your target audience earns a higher income (above $50k/year), choice of gift cards is an equally attractive option to cash and Visa prepaid cards.

If you are hoping to speak to unemployed people, avoid retailer-specific gift cards, even to large retailers like Amazon. A gift card would need to be loaded with around $37 more than a cash transfer to be valued equally (or $26 more than a Visa prepaid card).

Step 6: Ignore what doesn’t matter

It’s just as valuable to know what you don’t need to care about. Below is one such consideration, which didn’t yield any significant findings in our analyses.

Payment timing doesn’t matter

It matters how much you pay your participants, and how you pay them — but when you pay them doesn’t seem to make a difference for incentivization.

We tested a number of payment schemes:

upfront payment;

payment after the study was completed; and

a blend (with partial payment before and the remainder after).

No significant differences emerged between these options.

Step 7: Piece together research incentives your participant will love

We’ve run through all the variables and how they interact (or don’t). When building an incentive strategy for your research, keep these rules in mind:

1. Study length has the greatest influence on how participants perceive research incentives.

The relationship between study length and incentive expectations is not linear.

The longer your experiment runs, the cheaper each additional minute becomes.

If you were to increase the length of your study from 5 to 15 minutes, each of those ten additional minutes will cost you $1.76.

But if you were to lengthen a 30-minute study to 60 minutes, each extra minute will only cost $0.71.

2. Participants require more compensation for research modalities that involve human interaction.

Online interviews are more expensive than online surveys.

3. Studies revolving around sensitive subject matter are also more expensive if they’re on the longer side.

4. Cash transfers are always preferred, offering at least $9.50 additional value over any other incentive type we studied.

Participants were least interested in mailed checks. They needed the checks to be $13.37 greater to perceive them as equal in value to cash transfers.

5. Payment scheme (whether participants were compensated before the study, after, or a blend of the two) did not affect motivation.

6. Participant employment status and income level also did not show any significant effects in our analyses, with two exceptions:

Very high earners (>$200k/year) expected larger monetary incentives.

Students were the least expensive group, requiring only about 80% as much as other groups to achieve the same utility.

Step 8: Use our research incentive calculator

We’ve explained how it all works. Now that you understand the inputs, let us help you produce the outputs.

We built a research incentive calculator based on these insights. Input the characteristics of your study, and let it recommend the optimal research incentive.

Send research incentives using Tremendous

Ready to send your next batch of research incentives? If you don’t already, use Tremendous – it’s fast, free, global, and it integrates with your favorite research platforms.

Sign up and start sending immediately. You can also strategize on how best to set up your program by booking a demo with our sales team.

Thousands of brands trust Tremendous to send research incentives.

Hear how Atlassian scaled their research with us.

Or read about how Forsta unlocked more international business.

We've also helped academic researchers at University at Buffalo streamline the process of dealing with IRBs with our simple approach to incentives and reporting.

About the research

Tremendous is investing in research about incentives, so we can help you make more informed decisions. To achieve this goal, we’re also being transparent about the methodology, limitations, and what we’d like to study next.

If you have feedback, please write us at research@tremendous.com with the subject line “Feedback on your research incentive research.”

Benchmarking

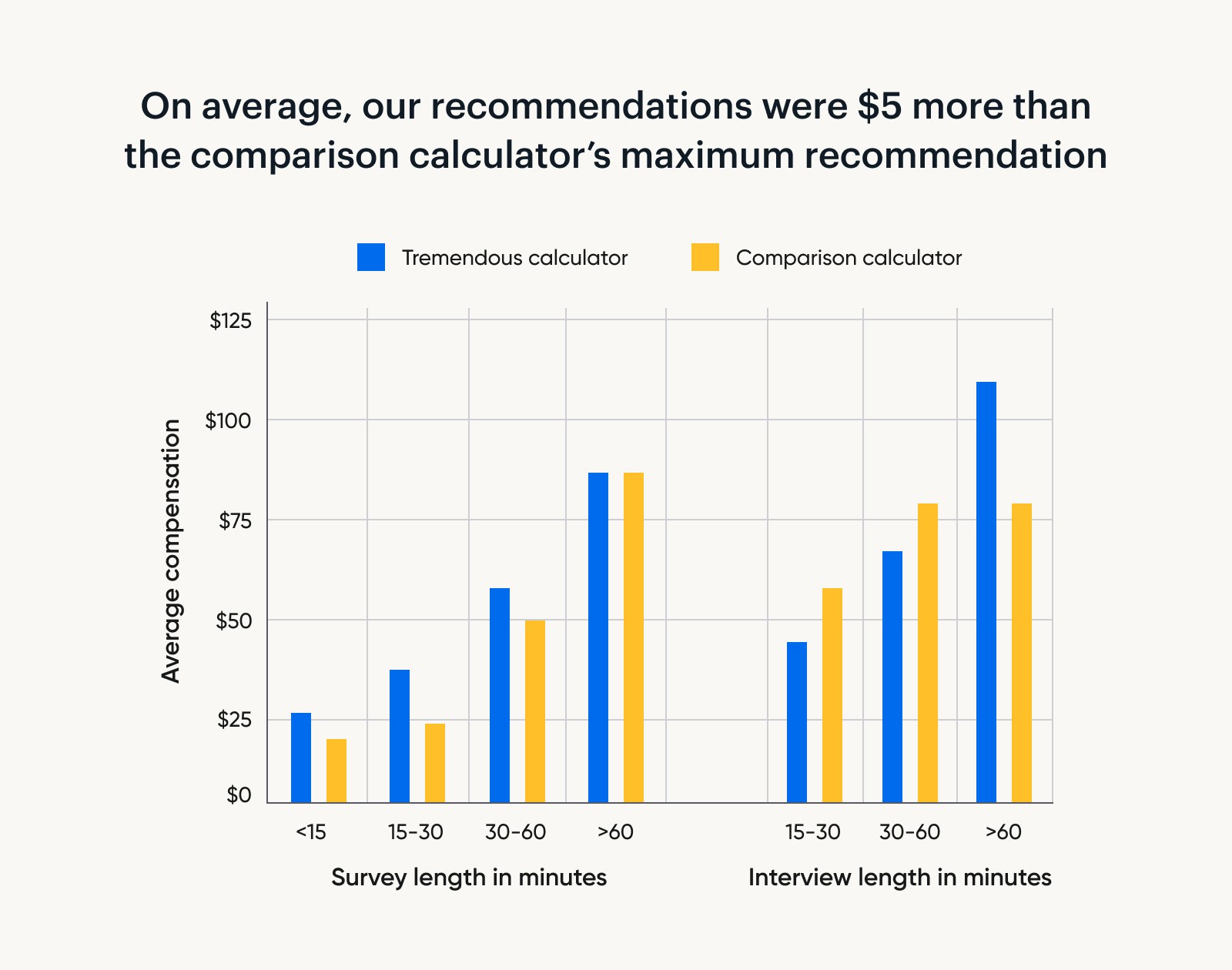

We compared our calculator’s outputs to those of existing incentive calculators, to see how these different methodologies stacked up. Here’s what we found:

Overall, our calculator was aligned with the upper range of the comparison calculator we chose (which provided minimum, average, and maximum incentive amounts).

On average, our recommendations were $5 more than the maximum incentive recommended by the comparison calculator. This was true across study formats (surveys vs. interviews) and various study lengths.

One interesting discrepancy was noted for interview incentives.

Our calculator starts off at a lower rate for short interviews. However, as interview length increases, we recommend relatively large increases in compensation.

On the other hand, the comparison calculator recommends a larger baseline incentive for short interviews, with smaller increases for longer interviews.

Given that the comparison calculator is based on observational data, this suggests that researchers may be overestimating how much money it takes to get someone through the door for an interview, and underestimating how much people value the additional time taken for longer interviews.

To further test how our calculator’s outputs compare with the current state of research incentives, we compared our recommendations with pay practices of over 150 real-world solicitations for research participants. These calls were published via two large online recruitment platforms.

We found a striking difference in the current state of research incentives across the two platforms. Specifically:

Across surveys and interviews of different lengths, the first platform’s payment practices aligned well with our recommendations. Across surveys and interviews of different lengths, their rates of compensation were between 57% and 152% of our calculator’s recommended incentive.

On the other hand, the second platform compensated participants at a much lower level. Across surveys of different lengths, their compensation clocked in somewhere between 8% and 38% of our calculator’s recommendation!

Methodology

The aims of this research, conducted in May 2023, included:

Understanding customers’ relative preference for different research incentive types and ways in which incentives are presented.

Testing whether incentive preferences differ for certain groups of participants.

Assessing how standard rates of compensation measure up with participants’ valuation of their own time.

Experimental design

We used a Discrete Choice Experiment (DCE). DCEs include a set of realistic, randomly generated options that participants choose between. For example, participants may be asked to select between a series of hypothetical research studies where types and rates of compensation and the lengths and topics of research vary randomly. By analyzing a large number of these choices, we gain insight into preference.

We used a large online research platform to test 300 people living in the US, with a balanced gender distribution. Each individual made 10 decisions, giving us a total of 3,000 data points.

Discrete Choice Experiment

We tested participant preferences for different types of research incentives, and how perceptions of research incentives varied depending on study characteristics. Participants were presented with information about two hypothetical research studies at a time, and then asked to indicate which one they would rather complete.

Example of choice set:

Following the DCE, we gathered demographic data (age, income, employment status) to test preferences between groups. During the experiment, we implemented attention checks to gauge data quality.

Analysis

Consistent with Hainmueller, 2014, we used a linear regression model to estimate the utilities/value associated with the levels of each attribute in each DCE. Only interactions that were significant at the 95% confidence level were reported. For each stage, we used separate models to test:

the main effect of each attribute

interactions between attributes

interactions between attributes and demographic factors

Each model included an estimate associated with changes in the size of the incentive. This estimate can be interpreted as the perceived value of an additional dollar added to the incentive. We used this estimated value of an additional dollar to convert the differences in perceived value between attribute levels into dollar values.